In the end the process turned out to be a flop. The oil companies first offered an opening bid for how much they expected to be paid for each barrel of increased output, and then the government reveled their price. The two sides were then to negotiate and agree upon an amount. In the end, only one consortium of British Petroleum (BP) and China’s CNPC won a bid for the South Rumaila field in Basra. BP-CNPC wanted $3.99 per extra barrel, while the government asked for $2. BP-CNPC ended up agreeing to the Oil Ministry’s price. That was because it was the smallest gap between the companies’ demands and the Ministry’s. In comparison, the government was willing to pay $8.50 for extra production from the Akkas gas field in Anbar, while the foreign businesses wanted $38. One natural gas field in Diyala didn’t even receive a bid.

It was apparent that Baghdad had unrealistic expectations about their offers, something Anthony Cordesman from the Center for Strategic and International Studies warned about after a recent trip to Iraq. He wrote that Iraqi officials were just thinking about the possible profits, and not about workable business models that international companies would accept. The first round of bidding seems to have proven his point.

This event was supposed to be a defining moment for Iraq’s oil industry. The country relies upon petroleum for almost all of its revenue, and with the drop in oil prices and budget deficit, the Oil Ministry was promising that this first round of bidding would open the country up to the foreign know how necessary to boost production, while protecting the nation’s resources. In the end it turned out to be a fiasco. Only one deal was agreed upon, and the Oil Ministry proved that it was out of touch with economic realities. With oil prices down, the companies, not the oil producing nations have the upper hand, as the former are desperate for deals, which gives the corporations more leeway to negotiate. This could’ve been expected as the Oil Minister’s plans have been ad hoc at best, and he’s scrapped earlier ideas to increase output in 2008. Iraq’s oil wealth will continue to be underdeveloped and mismanaged with this continued leadership, robbing the country of the money that it so desperately needs after years of wars and international sanctions.

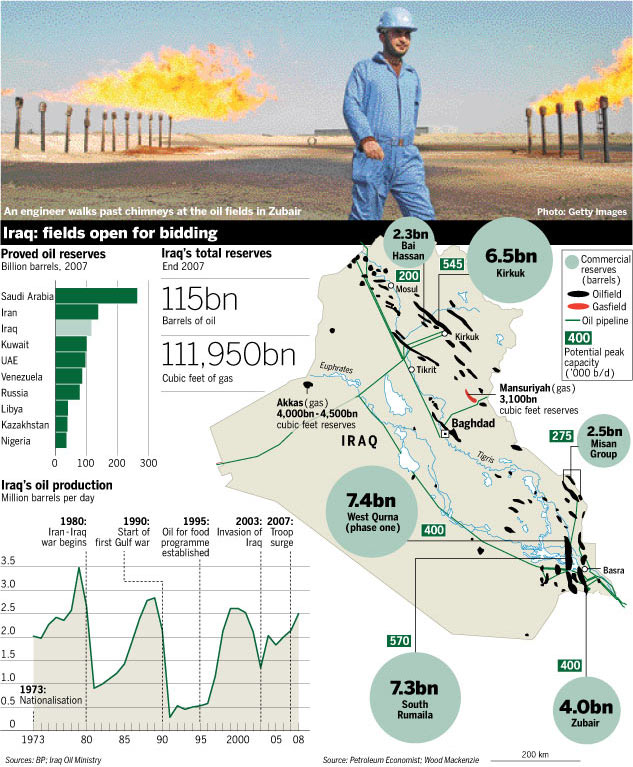

Oil And Natural Gas Fields And Bids

South Rumaila Oil Field – Basra Province

South Rumaila Oil Field – Basra ProvinceReserves: 7.3 billion barrels

Bidders:

1. British Petroleum and China’s CNPC

2. Exxon-Mobile and Malaysia’s Petronas

Initial Bid: BP-CNPC $3.99 per extra barrel

Oil Ministry’s Bid: $2 per extra barrel

Winning Bid: $2 per extra barrel by BP-CNPC

West Qurna Oil Field – Basra Province

Reserves: 7.4 billion barrels

Bidders:

1. Exxon-Mobile and Royal Dutch Shell

2. Spain’s Reposal with Denmark’s Maersk Oil and Gas and Norway’s Statoil Hydro

3. Russia’s Lukoi

4. France’s Total

5. China’s CNPC

Initial Bid: Exxon-Mobile and Royal Dutch Shell $4 per extra barrel

Oil Ministry’s Bid: $1 per extra barrel

No winners

Kirkuk Oil Field – Tamim Province

Reserves: 6.5 billion barrels

Bidders: Royal Dutch Shell and China’s Sinopec and Turkish Petroleum Corp

Initial Bid: $7.89 per extra barrel

Oil Ministry’s Bid: $2 per extra barrel

No winners

Zubair Oil Field – Basra Province

Reserves: 4 billion barrels

Bidders:

1. Italy’s Eni, China’s Sinopec, and South Korea’s Occidental and Korean Gas

2. India’s ONGC, Gazprom Russia, and Turkish Petroleum Corp

3. Exxon-Mobile, Royal Dutch Shell, and Petronas

4. British Petroleum and China’s CNPC

Initial Bid: Eni, Sinopec, Occidental and Korean Gas $4.80 per extra barrel

Oil Ministry’s Bid: Unknown

No winners

Maysan Group Oil Field – Maysan Province

Reserves: 2.5 billion barrels

Bidders: China’s CNOOC and Sinochem

Initial Bid: $21.40 per extra barrel

Oil Ministry’s Bid: $2.30 per extra barrel

Deal has been referred to Iraqi cabinet

Bai Hassan Oil Field – Maysan Province

Reserves: 2.3 billion barrels

Bidders: Conoco Phillips, China’s Sinopec and CNOOC

Initial Bid: $26.70 per extra barrel

Oil Ministry’s Bid: $4 per extra barrel

Deal has been referred to Iraqi cabinet

Akkas Natural Gas Field – Anbar Province

Reserves: 4,000-4,500 billion cubic feet

Bidders: Italy’s Edison, Malaysia’s Petronas, China’s CNPC, Turkey’s TPAO,

And Korea’s Gas Corp

Initial Bid: $38 for extra production

Oil Ministry’s Bid: $8.50 for extra production

No winners

Mansuriyah Natural Gas Field – Diyala Province

Reserves: 3,100 billion cubic feet

Bidders: None

SOURCES

Aswat al-Iraq, “Plan to develop Bai Hassan, Kirkuk oil fields,” 7/4/09

Chmaytelli, Maher and DiPaola, Anthony, “Iraq Says May Earn 100 Times More Than Oil Companies (Update1),” Bloomberg, 6/23/09

Chon, Gina, “Big Oil Ready for Big Gamble in Iraq,” Wall Street Journal, 6/24/09

- “Foreign Firms Bid for Iraqi Oil Licenses,” Wall Street Journal, 6/30/09

- “Oil Companies Reject Iraq’s Contract Terms,” Wall Street Journal, 7/1/09

Cordesman, Anthony, “Observations From a Visit to Iraq,” 6/15/09

Dow Jones, “UPDATE:Iraq Parliament Panel: Rumalia Deal Needs Lawmakers’ OK,” 7/3/09

Hafidh, Hassan, “FOCUS: Oil Majors Line Up For Iraq’s First Bid Round,” Dow Jones, 6/29/09

Hoyos, Carola, Warrell, Helen, and Bernard, Steve, “Crude Competition,” Financial Times, 6/30/09

Al Jazeera, “Foreign oil firms reject Iraq terms,” 6/30/09

Lando, Ben, “Oil bid debrief,” Iraq Oil Report, 7/8/09

Lando, Ben and Latif, Nizar, “One oil field awarded, many questions remain,” Iraq Oil Report, 6/30/09

Londono, Ernesto, Ibrahim, K.I., and Mufson, Steven, “Anxious Oil Giants Pass on Iraq,” Washington Post, 7/1/09

Reuters, “Iraq To Move Up Second Energy Bidding Round,” 7/2/09

Salaheddin, Sinan, “Iraqi PM dissatisfied with energy auction results,” Associated Press, 7/2/09

Sly, Liz, “Iraq awards BP-led consortium a contract to develop oil field,” Los Angeles Times, 7/1/09

No comments:

Post a Comment